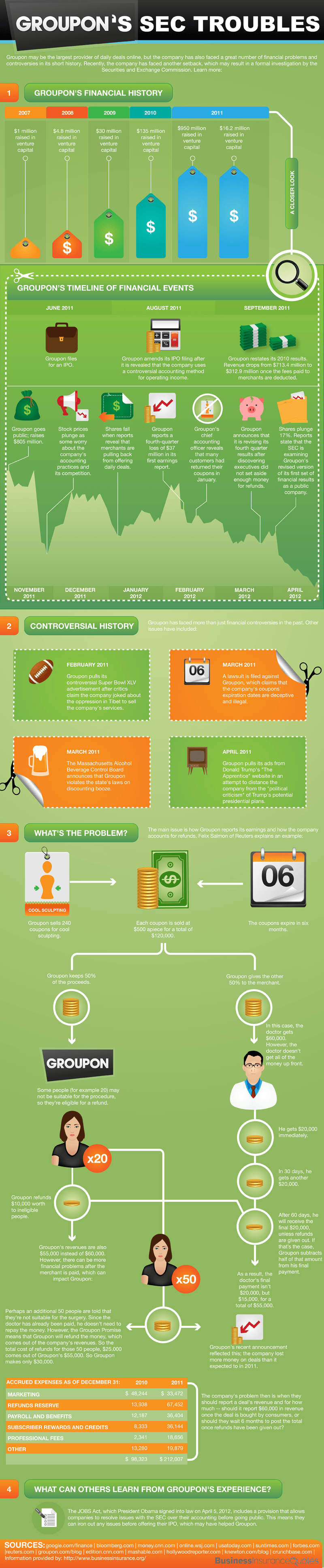

Groupon is being investigated by the SEC after information was released regarding Groupon’s questionable accounting and financial recording practices.

The online deal business model is one that has taken off in the last couple years with companies such as Groupon, LivingSocial, Google and Amazon all battling for a piece of the pie.

See Also: Online Deal Sites Timeline of Evolution [Infographic]

An infographic (posted below) was recently published by BackgroundCheck.org that provides us with a great overview of why Groupon is being investigated by the SEC and how their accounting practices can be unreliable.

Highlights of the Groupon SEC Investigation Infographic:

- Since 2007, Groupon has raised over $1.2 billion in venture capital.

- In June of 2011 Groupon filed for their IPO.

- In August of of 2011 the Groupon IPO was amended after information was released regarding their questionable accounting methods.

- In September of 2011 Groupon recalculated their 2010 revenue to be nearly 50% of the original figure ($713 million down to $312 million).

- Later in 2011 it is revealed that Groupon has not been setting enough money aside for refunds.

- Groupon reported a net loss in the 4th quarter of 2011.

- The Groupon share price continues to drop as there is increased scrutiny regarding their financial accounting practices.

-

Cause of the problem?

- Groupon pays merchants before calculating refunds.

- Merchants do not need to pay back money on refunds; Groupon eats all costs.

- Revenue is accounted for and reported before all refunds have been made.

As there are so many companies attempting to make use of the online deal site business model. It will be interesting to see how the SEC’s investigation of Groupon pans out and what effect it will have on the industry as a whole.