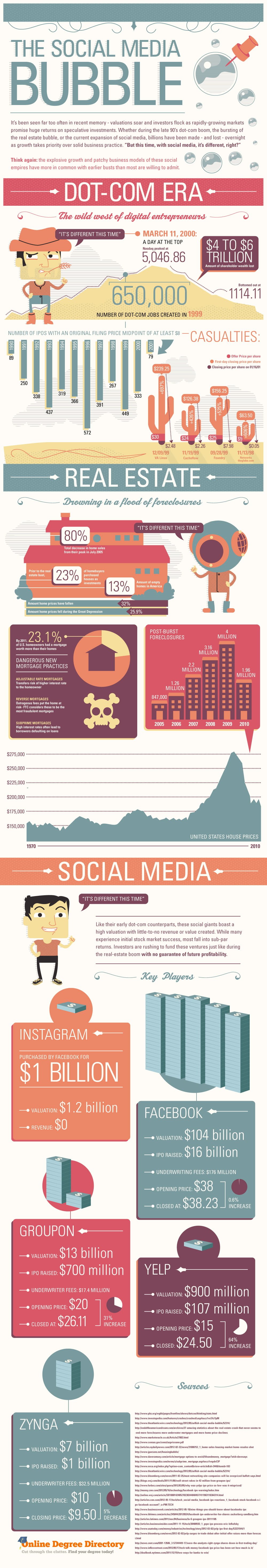

Is social media another tech bubble waiting to burst?

This is the question many people have been asking in recent years as social media platforms continue to grow and file for their IPOs.

Tech bubbles and other economic bubbles often occur when there is high speculation that new technologies, and companies pursing them, will be profitable regardless of what traditional economic metrics tell us.

Stock prices soar, confidence increases and then, almost instantly, investors’ over-confidence is realized, shares are sold and stock prices begin to plummet.

See Also: Groupon SEC Filing and Investigation Information [Infographic]

Many people feel that social media is not a tech bubble as the information acquired by companies such as Facebook and Twitter is so valuable that there is no denying their potential profitability.

If you look at the cold hard facts, however, the current economic state of social media seems very similar to the economic state of tech companies when the tech bubble burst in 2000.

An infographic (posted below) was recently published by Online Degree Directory that presents us with the similarities between the tech bubble burst of 2000 and the possible social media tech bubble we’re experiencing today.

The main message that this infographic conveys is that social media companies are receiving high valuation with little revenue generation to justify the valuation.

Do you think social media is just another tech bubble? Let me know in the comments section below!